- Welcome to Al-Mawaleh

- Majan building , Opposite CSK cafe ,Ghala,Muscat Governorate,Sultanate of Oman

Beyond the Money: Understanding the Real Financial Situation.

Cash to accrual accounting is a structured financial reporting transition that shifts businesses from recording transactions only when cash is received or paid to recognizing revenues and expenses when they are earned or incurred. This conversion is essential for presenting accurate, transparent, and reliable financial statements that reflect the true financial position of a business.

Moving to a cash-to-accrual basis significantly improves financial visibility, strengthens compliance with Omani regulatory expectations, and enhances audit readiness. Accrual-based reporting provides clearer insights into profitability, liabilities, and future obligations, enabling informed decision-making and better financial control.

Al Mawaleh supports businesses across Oman in transitioning smoothly to accrual accounting, ensuring accuracy, regulatory alignment, and minimal disruption. This shift improves financial clarity, supports investor confidence, and aligns reporting with modern governance and reporting standards.

Our professionals are widely recognized for supporting businesses in complex accounting transitions and advanced financial reporting reforms. Our expertise in cash to accrual accounting ensures that organizations achieve accurate reporting while remaining fully compliant with Omani regulations.

Our key strengths include experienced accounting and reporting specialists, strong knowledge of Omani corporate, VAT, and tax laws, and seamless digital conversion support. We offer transparent, flexible engagement models customized to business size and reporting complexity.

With Oman Vision 2040 and increasing regulatory modernization, authorities and stakeholders demand more accurate and comparable financial information. Accrual accounting ensures proper matching of revenues and expenses, offering a realistic view of financial performance.

Regulatory bodies such as MOCIIP, the Omani Tax Authority, and the Capital Market Authority (CMA) expect structured, accrual-based financial reporting for audits, funding, and compliance reviews. Proper cash to accrual adjustment supports regulatory acceptance and reduces reporting risks.

This shift also strengthens funding readiness, audit outcomes, and long-term growth by improving transparency and accountability.

For small and growing businesses, moving to accrual accounting improves understanding of actual cash flow trends and financial commitments. It supports better budgeting, forecasting, and cost control.

Accrual-based reporting enhances credibility with banks, investors, and partners while reducing compliance errors. With professional support, SMEs gain confidence in their financial data and long-term planning.

A. Financial Data Review

Comprehensive review of financial statements, ledgers, and bank transactions to identify gaps, inconsistencies, and missing records.

B. Adjustments & Accrual Entries

Preparation of accurate revenue and expense recognition entries, including prepayments, accruals, deferred revenue, and liabilities through structured cash to accrual adjustment processes.

C. Restated Financial Statements

Preparation of accrual-based profit & loss statements, updated balance sheets, and supporting schedules, including cash to accrual basis auditing notes where required.

D. Internal Controls & SOP Development

Development of standardized reporting processes, documentation controls, and internal accounting procedures to sustain accrual-based reporting.

Professional support helps businesses avoid financial misstatements, manage complex accrual entries, and ensure faster, error-free transitions. Expert guidance ensures compliance with Omani regulations while reducing pressure on internal teams.

Specialized advisors also assist with more intricate processes, including accrual-to-cash adjustment, accrual-to-cash conversion, or situations where organizations must convert accrual to cash for internal management reporting or regulatory requirements. Their expertise ensures that all entries are correctly recognized, reconciled, and documented, supporting reliable financial statements and improved decision-making.

Limited or inconsistent documentation makes it difficult to identify receivables, payables, and required accruals accurately.

Outdated accounting systems often lack the functionality needed for accrual-based reporting, increasing manual effort.

Missing or incomplete historical records create challenges in reconstructing prior-period financial information.

Manual bookkeeping increases the risk of errors, misstatements, and reconciliation issues during conversion.

Lack of technical accounting expertise can slow the transition and lead to compliance and reporting risks.

To ensure a smooth and accurate transition to accrual-based accounting, businesses must provide complete and well-organized financial records. These documents help identify timing differences, recognize outstanding balances, and prepare compliant accrual-based financial statements while reducing errors and delays.

Key Documents Needed:

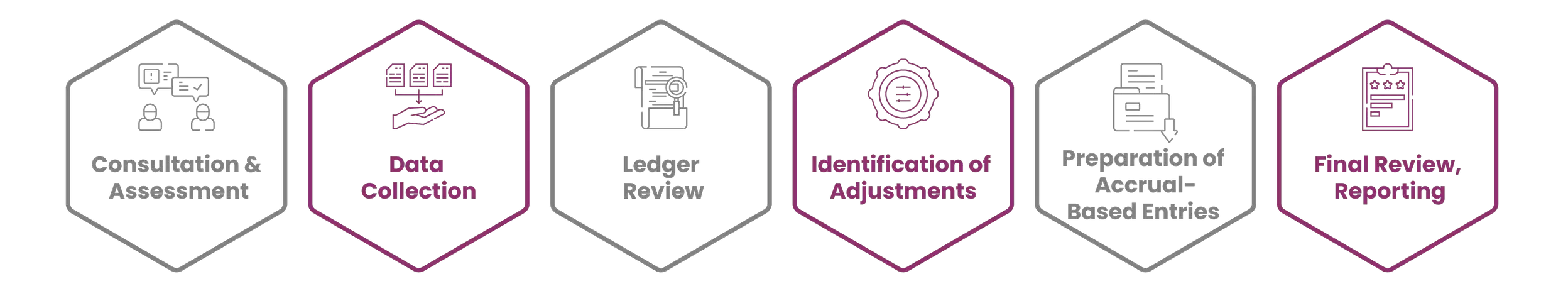

Consultation & Assessment to review current accounting practices and determine readiness for cash to accrual conversion.

Data Collection of financial records, statements, and supporting documents is required for accurate analysis.

Ledger Review to verify completeness, accuracy, and consistency of transactions.

Identification of Accrual Adjustments for revenues, expenses, prepayments, and liabilities.

Preparation of Accrual-Based Entries & Restatement of financial statements in line with accrual principles.

Final Review, Reporting & Training to deliver updated reports and guide teams for future accrual-based reporting.

AI-enabled tools streamline the conversion process by automating ledger classification and intelligently mapping receipts and expenses to the correct accrual periods. This reduces reliance on manual adjustments and ensures consistent, accurate treatment of income and costs across reporting cycles.

Real-time dashboards provide clear visibility by allowing businesses to compare cash-based and accrual-based views side by side, supporting better forecasting and performance analysis after conversion. Overall, this technology-driven approach enhances data accuracy, minimizes errors, and strengthens financial transparency for more informed decision-making.

| Project Stage | Estimated Duration | Estimated Cost (OMR) | Notes |

|---|---|---|---|

| Initial Assessment | 2–4 days | 400 – 700 | Review of existing records, accounting method, and readiness for conversion |

| Data Clean-Up | 1–2 weeks | 900 – 1,600 | Data validation, reconciliation, and correction of gaps or inconsistencies |

| Restatement & Entries | 1–3 weeks | 1,800 – 3,200 | Preparation of accrual entries and restated financial statements |

| Finalization | 3–5 days | 500 – 900 | Final review, reporting, and management discussions |

Disclaimer:

The estimated timelines and costs are indicative and provided for general guidance only. Actual duration and fees may vary based on data volume, accounting system quality, transaction complexity, industry-specific requirements, and the availability of supporting documentation. A detailed review is required to provide a customized and accurate proposal.

Our cash to accrual accounting services support a wide range of industries across Oman. We understand that each sector has distinct financial structures, reporting challenges, and compliance requirements. By tailoring our approach, we help businesses achieve accurate accrual-based reporting, improved financial visibility, and regulatory alignment.

This industry-focused approach ensures businesses remain compliant, audit-ready, and better positioned for informed decision-making and sustainable growth.

Ready to take your finances to the next level? Book an appointment with Al Mawaleh today! Our professional team is here to provide personalized solutions that clarify finances and build trust. Let’s work together to ensure your business’s financial success.

Businesses rely on Al Mawaleh for the expertise of seasoned financial professionals who understand the technical and regulatory complexities of accounting conversions. Our team brings practical experience and sound judgment to ensure accuracy, compliance, and clarity at every stage of the engagement.

We provide complete, end-to-end guidance throughout the conversion process, from initial assessment to final reporting. With a strong understanding of Omani regulatory requirements, we help businesses handle compliance confidently while minimizing disruption to daily operations.

By combining advanced, AI-driven reporting tools with a scalable and cost-effective service model, we deliver precise and efficient outcomes for organizations of all sizes. Every engagement is handled with strict confidentiality, ensuring sensitive financial information remains fully protected.

Al Mawaleh is a leading financial consultant company in Oman, delivering expert accounting services, professional auditors, and trusted financial solutions advisor support for businesses through top financial consulting firms expertise.