- Welcome to Al-Mawaleh

- Majan building , Opposite CSK cafe ,Ghala,Muscat Governorate,Sultanate of Oman

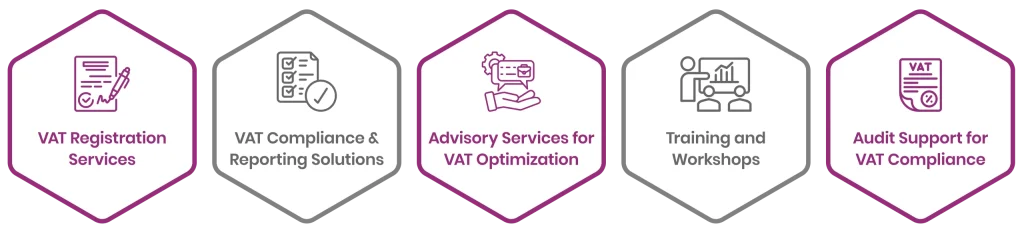

Optimize Your VAT Strategy: Efficiency, Accuracy, Savings

We are delighted to present AL Mawaleh as your dependable accomplice in giving expert VAT Consultancy Services in Oman. In light of the recent changes that businesses have had to adapt to in the Value Added Tax (VAT) that went into effect in 2021, our professional team of VAT consultants in Oman is here to help you with the process. We will help your business with VAT registration compliance and audit to achieve the success value added tax in Oman

It is a consumption-based tax applied at various stages of supply and includes VAT (goods and service tax). Introduction of Oman was a major fiscal event to enhance the country’s economy. Failing to understand how tax is calculated and collected and remitted for businesses means they could be non-compliant with the regulations of Oman’s tax authorities.

Our VAT consultancy services in Muscat Oman also provides easy access to businesses of all sizes simplifying the process at AL Mawaleh. This is for you whether you’re new to the market or looking to optimize operations.

The implementation of value added tax in Oman has created both challenges and opportunities for businesses. Key aspects of VAT include:

Documents required for VAT registration in Oman: Trade license financial records and more ensuring compliance with Oman’s VAT registration number process.

Oman’s VAT system impacts businesses from small retailers to multinational corporations and the role of Oman VAT consultants like us is vital in simplifying compliance.

VAT registration involves providing a set of documents to Oman’s tax authorities such as

Our expertise ensures accurate submission and faster processing, getting you your Oman VAT number efficiently.

Advantages:

Disadvantages:

Our role as experienced consultants in Oman is to ensure the advantages of VAT outweigh any challenges for your business.

Ready to take your finances to the next level? Book an appointment with Al Mawaleh today! Our professional team is here to provide personalized solutions that clarify finances and build trust. Let’s work together to ensure your business’s financial success.

VAT is a tax on consumption and it delivers the cost to the end consumer. It is levied on every segment of the supply chain where value is added.

Specific goods / services are zero rated or exempt at a standard tax rate of 5%.

We simplify VAT registration compliance and reporting ensuring your business operates efficiently while adhering to Omans tax laws.

Al Mawaleh is a leading financial consultant company in Oman, delivering expert accounting services, professional auditors, and trusted financial solutions advisor support for businesses through top financial consulting firms expertise.