- Welcome to Al-Mawaleh

- Majan building , Opposite CSK cafe ,Ghala,Muscat Governorate,Sultanate of Oman

Excise Tax Simplified: Let Us Manage the Details; You Reap the Rewards

Excise tax is a government-imposed indirect tax applied to specific goods identified under regulatory frameworks. Its primary purpose is to regulate the production, import, and distribution of these goods while generating public revenue. In Oman, excise tax regulations directly affect product pricing, profit margins, compliance obligations, and overall business cash flow.

For businesses dealing in excisable goods, accurate reporting and timely filings are mandatory. Even minor errors can result in penalties, audits, or operational disruptions.

Al Mawaleh assists businesses with registration, reporting, and ongoing compliance. With expert guidance and a structured approach, excise tax obligations can be managed confidently and efficiently through Excise tax advisory, allowing businesses to remain compliant while focusing on growth.

Al Mawaleh has earned a strong reputation for providing regulatory and tax compliance services to businesses. Our advisory approach is grounded in technical expertise and a clear understanding of local excise laws.

Businesses trust Excise tax advisory services from Al Mawaleh because we combine regulatory precision with practical business

Excise tax is not optional. Any business dealing with excisable goods must comply with registration and payment obligations. Failure to do so can affect pricing strategies, reduce margins, and invite audits from tax authorities.

Timely declarations, accurate calculations, and proper documentation are essential. With increasing regulatory checks, companies must stay proactive rather than reactive. Expert Excise tax advisory in Oman supports ensuring businesses remain compliant while avoiding unnecessary financial exposure.

Excise regulations apply to specific product categories identified by the authorities. These include tobacco and tobacco-related products, carbonated drinks, energy drinks, alcoholic products where permitted, and any other goods classified under excise laws.

Accurate product classification is essential for compliance, as incorrect classification may result in underpayment of tax, penalties, or regulatory action under excise tax regulations.

Our services provide practical excise tax support to help businesses meet regulatory requirements.

A. Registration & Applicability Assessment

We begin by assessing whether your products are subject to excise regulations. Our team evaluates excise exposure, assists with registration, and supports accurate product classification in line with excise tax rules.

B. Compliance & Return Support

Our experts handle the preparation and filing of periodic excise returns. We verify reported quantities and values, submit returns, and coordinate directly with authorities to ensure seamless Excise tax filing.

C. Advisory & Transaction Review

We provide guidance on pricing impact, review import and manufacturing transactions, and offer ongoing interpretation of regulatory updates related to excise tax.

Many companies prefer to outsource excise tax compliance because it reduces the risk of errors and penalties that can arise from complex regulations. External advisors bring specialized knowledge of excise rules, product classifications, and reporting requirements, which ensures filings are accurate and consistent. Outsourcing also frees up internal teams to focus on core business operations instead of spending time on technical tax matters. By working with an experienced excise tax advisory company, businesses gain peace of mind knowing that compliance is handled professionally. This approach not only improves efficiency but also provides long‑term stability and confidence in dealing with regulators.

Excise compliance can be difficult for businesses due to several recurring challenges. Incorrect product classification often leads to wrong tax calculations, while quantity reporting errors can trigger penalties or audits. Maintaining detailed records across multiple transactions is complex, especially when regulations change frequently. Many companies also struggle with limited internal expertise, making it hard to keep up with evolving excise requirements. Addressing these issues requires structured compliance support, continuous monitoring, and guidance from professionals who understand both local and international excise frameworks. With the right support, businesses can avoid costly mistakes and maintain smooth operations.

To meet excise obligations, businesses typically need:

Proper documentation supports smooth audits and effective exercise advisory services in Oman.

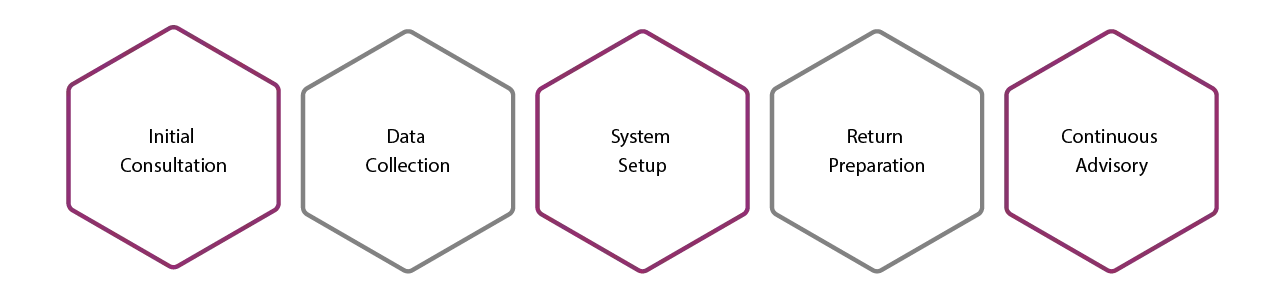

A clear, organized process is key to efficiently managing excise tax.

1. Initial Consultation and Excise Exposure Assessment

We start by understanding your business, products, and supply chain. Our team identifies which goods are subject to excise tax, assesses potential exposure, and highlights compliance risks.

2. Data Collection and Transaction Analysis

We gather all necessary records, including production, import, and sales data. Each transaction is carefully analyzed to ensure correct reporting of quantities and product classifications under excise tax rules.

3. Registration and System Setup

We assist with registration with the relevant authorities and set up systems for tracking excisable products. This ensures that all reporting obligations are automated and ready for timely submission.

4. Return Preparation and Filing

Our team prepares periodic excise tax returns, verifies the accuracy of reported data, and submits filings to authorities. This ensures Excise tax filing and minimizes the risk of errors or penalties.

5. Continuous Advisory and Compliance Monitoring

We provide continuous advisory support and help implement procedural changes to maintain accurate reporting and compliance with excise regulations.

An overview of the estimated timelines and costs for our excise tax services:

| Service Stage | Estimated Timeline | Estimated Cost (OMR) |

|---|---|---|

| Applicability Review | 2–3 working days | 120 – 195 OMR |

| Registration and Setup | 5–7 working days | 234 – 390 OMR |

| Return Preparation & Filing | 3–5 working days | 156 – 273 OMR |

| Ongoing Support | Monthly / Quarterly | 78 – 195 OMR/month |

Note: Costs are indicative and may vary depending on the complexity and volume of excisable products.

Failure to comply with excise tax rules can result in serious financial and regulatory consequences. Businesses may face fines for late registration, penalties for incorrect declarations, or even restrictions on non‑compliant stock movements. These enforcement actions can disrupt supply chains, damage reputation, and create unexpected costs. Proactive excise tax planning in Oman helps companies avoid such risks by ensuring obligations are met on time and records are maintained properly. By staying ahead of compliance requirements, businesses protect themselves from costly disputes and build stronger trust with regulators and stakeholders.

To ensure accurate and efficient Excise tax advisory services, we use the following tools:

Artificial intelligence is transforming excise tax compliance by making processes faster, smarter, and more reliable. Our AI‑supported systems validate quantities and values automatically, reducing the chance of human error. They send compliance alerts before deadlines, identify risks through transaction analysis, and highlight unusual patterns that may require attention. Dashboards provide real‑time monitoring of excise exposure, giving managers a clear view of obligations and risks. By integrating AI, businesses gain predictive insights, improve accuracy, and reduce the burden of repetitive tasks. This technology ensures compliance is not only maintained but also optimized for efficiency and transparency.

We work with a wide range of sectors, including:

Our industry experience strengthens our Excise tax advisory and expertise.

Ready to take your finances to the next level? Book an appointment with Al Mawaleh today! Our professional team is here to provide personalized solutions that clarify finances and build trust. Let’s work together to ensure your business’s financial success.

Businesses choose Al Mawaleh for our regulatory strength, practical advisory approach, technology-driven accuracy, and confidential engagement model. We focus on building long-term compliance partnerships and providing trusted Oman tax advisory services to help businesses efficiently manage excise tax and regulatory obligations.

Al Mawaleh is a leading financial consultant company in Oman, delivering expert accounting services, professional auditors, and trusted financial solutions advisor support for businesses through top financial consulting firms expertise.