- Welcome to Al-Mawaleh

- Majan building , Opposite CSK cafe ,Ghala,Muscat Governorate,Sultanate of Oman

Achieve Financial Stability and Sustainable Success.

Adapting to today’s dynamic financial environment requires businesses to maintain a well-structured capital base. Capital restructuring refers to the process of reorganizing debt and equity to improve financial stability, lower costs, and prepare for growth opportunities. Whether addressing liquidity challenges or optimizing shareholder agreements, capital restructuring allows businesses to realign their financial strategy and enhance performance.

Oman’s thriving investment climate, underpinned by Vision 2040 and its push for economic diversification, makes capital restructuring services Oman increasingly relevant. At Al Mawaleh, we specialize in empowering businesses through strategic debt restructuring, equity optimization, and financial realignment. Committed to compliance with regulations outlined by Oman’s Commercial Companies Law and supported by collaboration with banks and financial institutions, we help companies navigate the complexities of restructuring and achieve sustainable success.

Lower Debt Servicing Burden: Restructure debt to improve cash flow and reduce interest obligations.

Improved Investor Confidence: A clean and optimized capital structure attracts new investments and strengthens relationships with existing stakeholders.

Stronger Credit Rating and Financial Ratios: Enhance your creditworthiness by aligning your balance sheet and financial ratios with industry standards.

Enhanced Ability to Raise New Capital: Reorganizing your capital structure positions your company favorably for fundraising efforts.

Increased Agility and Risk Management: Improve responsiveness to market changes and mitigate potential financial risks effectively.

Aligning with Oman Vision 2040: Support Oman’s goal of developing a competitive private sector that drives economic growth and diversification.

Strengthening Investor Confidence: Position your company as investment-ready with a streamlined capital structure that appeals to regional and foreign investors.

Adapting to Economic Shifts: Respond to market volatility and interest rate fluctuations with a flexible restructuring strategy.

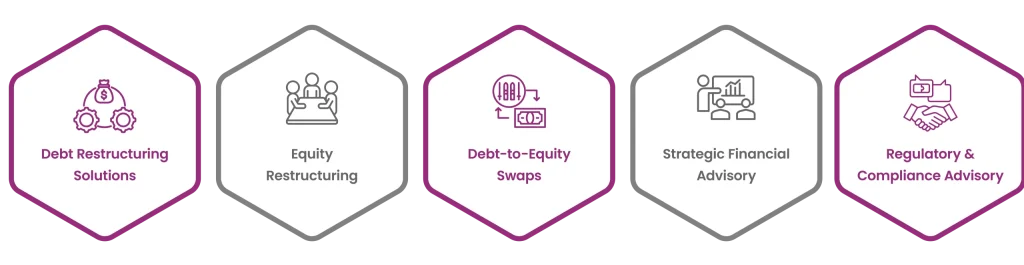

Debt Restructuring Solutions

Equity Restructuring

Debt-to-Equity Swaps

Strategic Financial Advisory

Regulatory & Compliance Advisory

In-Depth Local Knowledge: We understand Oman’s financial and legal landscape, ensuring compliant and tailored solutions for restructuring.

End-to-End Support: From initial audits to implementation, our services offer comprehensive guidance for businesses.

Confidential, Strategic Advice: Our approach is sensitive to corporate decisions, delivering results-driven strategies in complete confidentiality.

Ready to take your finances to the next level? Book an appointment with Al Mawaleh today! Our professional team is here to provide personalized solutions that clarify finances and build trust. Let’s work together to ensure your business’s financial success.

Indicators include high debt levels, reduced liquidity, declining investor confidence, and inability to raise funds effectively.

Yes, restructuring can help SMEs optimize debt and equity, improve financial health, and prepare for growth opportunities.

Timelines vary based on complexity, but most projects are completed within 3–6 months.

Key documents include financial statements, shareholder agreements, loan contracts, and business plans detailing objectives for restructuring.

Al Mawaleh is a leading financial consultant company in Oman, delivering expert accounting services, professional auditors, and trusted financial solutions advisor support for businesses through top financial consulting firms expertise.