- Welcome to Al-Mawaleh

- Majan building , Opposite CSK cafe ,Ghala,Muscat Governorate,Sultanate of Oman

Employing Expert Accounting Services to Maximize Your Business from Ledger to Success

Employee Insurance Services are designed to protect your workforce against health, life, and work-related risks. Comprehensive coverage ensures employees receive timely medical care, financial support during accidents, and protection against unexpected workplace incidents.

Structured employee insurance safeguards your team while supporting long-term compliance with labor laws and regulatory requirements. Expert guidance helps employers select the right policies, coordinate with insurers, and maintain employee satisfaction and trust.

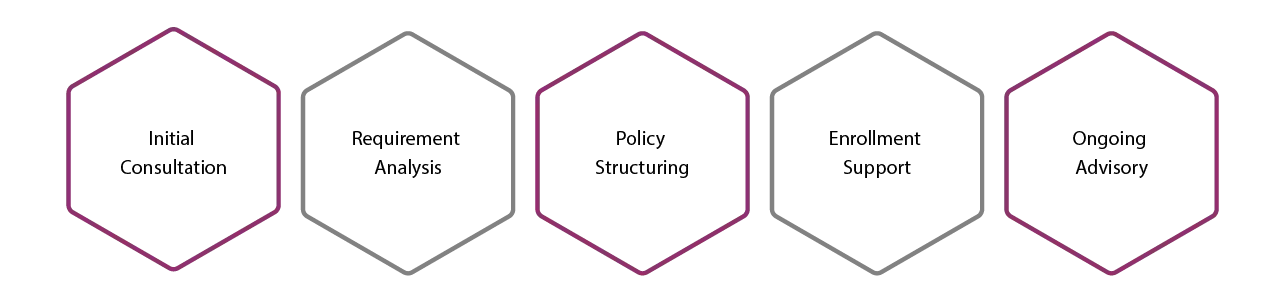

With customized employee insurance Oman solutions, organizations can align coverage with workforce size, roles, and risk profiles. We assist in policy structuring, employee enrollment, and claims management, ensuring smooth administration, enhanced employee confidence, and overall operational continuity.

Our firm is recognized for delivering reliable and compliance-focused Employee Insurance Services.

Key Differentiators:

Our solutions ensure organizations efficiently manage employee national insurance in Oman and maintain employees’ social insurance compliance while providing peace of mind to their workforce.

Proper employee insurance coverage plays a critical role in protecting employees against health issues and workplace risks while enhancing employer credibility and improving retention rates. It ensures compliance with regulatory and labor law requirements, reducing the likelihood of legal complications.

Additionally, comprehensive coverage lowers financial exposure and safeguards businesses against unexpected liabilities. These factors make Oman insurance employees’ programs an essential component of effective workforce management and long-term business continuity.

A. Health & Medical Coverage Advisory

B. Life & Personal Accident Coverage

C. Work-Related Risk Coverage

Outsourcing corporate insurance in Oman offers several advantages for businesses. It provides access to professional insurance advisory and expertise, ensuring that coverage is Customised to workforce needs.

This approach enables cost-effective structuring of policies, reduces the administrative burden on HR teams, and ensures ongoing monitoring, updates, and compliance. By leveraging external expertise, companies can focus on core operations while maintaining comprehensive employee protection.

Employers often encounter the following challenges:

Professional advice helps mitigate these challenges while maintaining compliance and operational efficiency.

To streamline employee insurance enrollment, accurate documentation is required.

Key Documents Needed:

| Project Stage | Estimated Timeline | Estimated Cost (OMR) | Notes |

|---|---|---|---|

| Policy Assessment & Structuring | 3–5 working days | 300 – 500 | Workforce evaluation and coverage planning |

| Insurer Coordination & Quotations | 5–7 working days | 400 – 700 | Compare and select optimal plans |

| Policy Issuance & Employee Enrollment | 3–5 working days | 500 – 800 | Ensure all employees are enrolled properly |

| Ongoing Support | Annual / Renewal-based | 200 – 400 per year | Monitoring, updates, and claims assistance |

Disclaimer: Timelines and costs are indicative and may vary based on workforce size, coverage needs, and insurer requirements.

AI enhances Employee Insurance Services by improving accuracy, efficiency, and decision-making across the insurance process. It enables smart analysis of workforce risk profiles, automates policy comparison and optimization, and provides predictive insights for claims and renewals.

Intelligent dashboards allow employers to monitor coverage, compliance, and employee benefits in real time. By leveraging AI, organizations can reduce manual errors, plan proactively, and manage employee insurance more effectively and efficiently.

Our employee insurance Oman solutions cater to a wide range of industries, recognizing that each sector has unique workforce needs and regulatory requirements. These services help businesses provide comprehensive employee benefits, ensure compliance, and maintain operational efficiency.

Industries That Benefit from Our Services:

Ready to take your finances to the next level? Book an appointment with Al Mawaleh today! Our professional team is here to provide personalized solutions that clarify finances and build trust. Let’s work together to ensure your business’s financial success.

Al Mawaleh delivers compliance-driven employee insurance in Oman, offering customized insurance solutions that meet the specific needs of diverse workforces. Each policy is structured to provide comprehensive protection while aligning with organizational goals and regulatory requirements.

We ensure confidential handling of employee data and maintain strong coordination with insurers, facilitating smooth policy administration and timely claims processing. This approach minimizes administrative burdens and streamlines workforce coverage management.

Additionally, Al Mawaleh provides reliable guidance for renewals, claims, and ongoing compliance. Our services help organizations protect their employees effectively, maintain regulatory adherence, and manage insurance programs efficiently, fostering a secure and well-supported workforce.

Al Mawaleh is a leading financial consultant company in Oman, delivering expert accounting services, professional auditors, and trusted financial solutions advisor support for businesses through top financial consulting firms expertise.