- Welcome to Al-Mawaleh

- Majan building , Opposite CSK cafe ,Ghala,Muscat Governorate,Sultanate of Oman

Strategies and Insights into Business Valuation

Knowing the true value of your business is a crucial factor in making informed financial and strategic decisions. Business valuation is not just about assigning a monetary value—it’s about understanding the market position, growth opportunities, and financial health of your business. Whether you’re preparing for mergers and acquisitions (M&A), seeking investments, restructuring, resolving legal disputes, or planning for family business transitions, valuation plays a pivotal role.

As Oman undergoes significant economic reforms aligned with Vision 2040, there’s a surge in demand for company valuation services in Oman due to rising foreign direct investments (FDI) and the consolidation of businesses in key sectors. At Al Mawaleh, we offer reliable and compliant business valuation services to meet these needs, ensuring that your company’s worth is accurately assessed for various purposes while adhering to regulations set by the Ministry of Commerce, Industry & Investment Promotion (MOCIIP).

Requirements by Ministry of Commerce, Industry & Investment Promotion (MOCIIP): Conducting a business valuation in Oman requires compliance with the regulatory framework provided by MOCIIP. This ensures credibility, transparency, and alignment with local laws.

Valuation for Foreign Investors: For international entities entering Oman, proper valuation helps assess net assets, growth potential, and market viability of target businesses, allowing investors to make informed decisions.

Tax and Audit Implications: Valuation has significant implications on financial reporting, taxation, and audit processes. Accurate assessment ensures that businesses comply with regulations under Oman’s Commercial Companies Law.

Importance of Compliance: Compliant valuations are essential for legal proceedings, investment negotiations, tax audits, and corporate restructuring in Oman.

Equity Valuation: Determine the value of individual stakeholder shares or the entire equity of the business, offering clarity for ownership transfers or partnerships.

Asset-Based Valuation: Evaluate tangible and intangible assets such as intellectual property, machinery, and trademarks to determine intrinsic company value.

Income-Based Valuation (Discounted Cash Flow): This method is ideal for businesses with strong future earnings projections, calculating the present value of projected cash flows.

Market-Based Valuation: We compare your company with similar businesses in Oman or the GCC region to provide a fair market valuation aligned with industry benchmarks.

Valuation for Startups & SMEs: Specialized valuation models are tailored for early-stage companies, capturing their growth trajectory and innovative potential.

Valuation for Regulatory or Legal Purposes: These valuations are prepared for compliance with MOCIIP standards, audits, and legal disputes, ensuring credibility and accuracy in official proceedings.

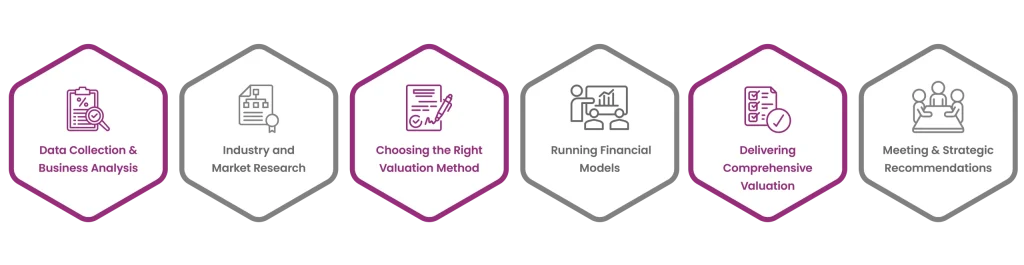

Data Collection & Business Analysis: We begin by gathering detailed information about your company, including financial statements, assets, liabilities, and market trends.

Industry and Market Research: Our analysts conduct in-depth research on market conditions, industry benchmarks, and competitive landscapes specific to Oman and the GCC region.

Choosing the Right Valuation Method: Depending on your business structure and goals, we select the best valuation techniques—whether income-based, asset-based, or market-based.

Running Financial Models: Using advanced financial modeling, we analyze metrics like growth rate, future earnings, and net assets to determine accurate business valuation.

Delivering a Comprehensive Valuation Report: Our valuation report includes detailed findings, strategic insights, and actionable recommendations tailored to your objectives.

Review Meeting & Strategic Recommendations: We conduct review meetings to discuss the report findings and advise on next steps, such as investments, mergers, or restructuring.

Deep Understanding of Oman’s Financial Ecosystem: With our strong expertise in Oman’s financial, legal, and regulatory framework, we deliver valuations that align with local standards and industry needs.

Registered, Experienced Financial Analysts: Our analysts have years of experience in business valuation consulting, ensuring accuracy and professionalism in every report.

Confidential and Compliant Reporting: At Al Mawaleh, we prioritize confidentiality while producing reports that comply with MOCIIP regulations for credibility and transparency.

Objective, Third-Party Credibility: As independent evaluators, we provide unbiased valuations accepted by courts, investors, and financial institutions across Oman.

End-to-End Support: From consultation to final recommendations, we offer comprehensive support tailored to your unique valuation needs.

Ready to take your finances to the next level? Book an appointment with Al Mawaleh today! Our professional team is here to provide personalized solutions that clarify finances and build trust. Let’s work together to ensure your business’s financial success.

The cost varies depending on the complexity and scope of your business. Contact us for a custom quote based on your valuation requirements.

Typically, we require financial statements, asset details, company ownership records, and any relevant legal agreements.

The duration depends on the scope of the valuation, but most projects are completed within two to six weeks.

Yes, all our valuations comply with Omani regulations and are recognized by legal authorities, investors, and financial institutions.

Absolutely! Our valuations are designed to provide accurate insights that support sales, mergers, or acquisitions.

Al Mawaleh is a leading financial consultant company in Oman, delivering expert accounting services, professional auditors, and trusted financial solutions advisor support for businesses through top financial consulting firms expertise.