- Welcome to Al-Mawaleh

- Majan building , Opposite CSK cafe ,Ghala,Muscat Governorate,Sultanate of Oman

Beyond the Risk: M&A Solutions for Sustainable Success and Secure Transactions

Mergers and acquisitions play a vital role in business growth, enabling companies to expand, restructure capital, and create shareholder value. Professional advice ensures that every transaction is well-structured, accurately valued, and compliant with regulations.

Al Mawaleh provides trusted Merger & Acquisition services, guiding businesses through complex deals while aligning strategies with corporate goals. Our expert guidance reduces risk, streamlines processes, and ensures regulatory compliance.

Al Mawaleh has a strong reputation for handling complex corporate transactions across the GCC. We have extensive experience advising mergers and acquisitions companies on deal strategy, valuation, and integration.

Our key strengths include:

Professional Merger & Acquisition services help companies expand into new markets, restructure capital, plan exits, and maximize shareholder value. They also ensure that every transaction is executed in full compliance with regulatory requirements.

Our expertise in business mergers and acquisitions allows companies to navigate these complex processes efficiently, minimize risks, and achieve their strategic growth objectives.

Professional M&A advisory helps SMEs access growth opportunities and secure fair, well-structured deals. It ensures that every transaction is financially sound and aligned with business goals.

SMEs also benefit from guidance in negotiations and investor relations through mergers and acquisitions advisory, reducing financial and operational risks while making confident, informed decisions.

Our Merger & Acquisition services guide businesses through every stage, from identifying targets to post-merger integration.

A. Target Identification

We identify and evaluate potential acquisition targets, focusing on market fit and strategic alignment.

B. Due Diligence

We perform detailed financial, legal, and regulatory reviews to uncover and address potential risks.

C. Valuation & Deal Structuring

We provide robust merger and acquisition analysis, perform business and asset valuation, and structure transactions to achieve optimal outcomes.

D. Post-Transaction Support

We assist with integration planning, operational alignment, and financial monitoring to ensure a smooth post-merger transition.

Outsourcing allows companies to access specialized expertise without adding internal burden.

Our M&A advisory services in Oman deliver:

Businesses often encounter challenges in M&A transactions, including incomplete or inconsistent financial information, regulatory and approval delays, valuation mismatches, and integration or cultural issues.

Our team provides structured planning and expert guidance to address these challenges, offering support as a trusted merger and acquisition consultant in Oman to ensure smooth and successful transactions.

Having the right documentation ready is essential for effective M&A advisory and timely deal execution. Key documents include:

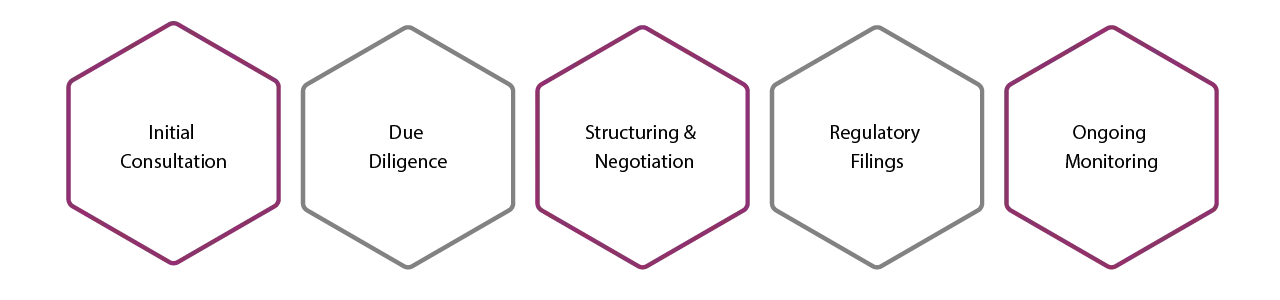

Our Merger & Acquisition services follow a structured process to ensure smooth and successful transactions:

Estimated timelines and costs for Merger & Acquisition services:

| Stage | Estimated Timeline | Estimated Cost (OMR) |

|---|---|---|

| Initial assessment | 3–5 days | 200 – 300 OMR |

| Due diligence & valuation | 2–4 weeks | 500 – 800 OMR |

| Structuring & negotiations | 1–3 weeks | 400 – 700 OMR |

| Integration support | 2–6 weeks | 600 – 1,000 OMR |

Disclaimer: Timelines and costs vary depending on deal complexity and scope.

We use advanced technology and tools that support our Merger & Acquisition services.

AI plays a key role in enhancing our Merger & Acquisition services by providing automated risk and due diligence alerts and predictive scenario modeling. This helps businesses identify potential challenges and make informed decisions throughout the transaction process.

Additionally, AI enables data-driven valuation and real-time deal-tracking dashboards, giving decision-makers clear visibility into every stage of a merger or acquisition and enabling timely, strategic actions.

Our advisory services span multiple sectors:

Ready to take your finances to the next level? Book an appointment with Al Mawaleh today! Our professional team is here to provide personalized solutions that clarify finances and build trust. Let’s work together to ensure your business’s financial success.

Choosing the right partner is essential for successful mergers and acquisitions. Clients rely on Al Mawaleh for professional Merger & Acquisition services because we combine experience, expertise, and a structured approach to deliver results with confidence.

Al Mawaleh is a leading financial consultant company in Oman, delivering expert accounting services, professional auditors, and trusted financial solutions advisor support for businesses through top financial consulting firms expertise.