- Welcome to Al-Mawaleh

- Majan building , Opposite CSK cafe ,Ghala,Muscat Governorate,Sultanate of Oman

Empowering Your Workforce, Simplifying Your Payroll: Seamless HR Solutions for Success.

HR & Payroll Services play an essential role in ensuring organizational stability, regulatory compliance, and employee satisfaction. Effective human resources and payroll management enable businesses to administer salaries accurately, manage employee records efficiently, and comply with evolving labour laws and statutory requirements. A structured HR and payroll framework not only reduces operational risks but also strengthens workforce governance and long-term business sustainability.

Al Mawaleh supports SMEs, startups, and established enterprises by delivering professional hr and payroll management solutions, customized to organizational needs. Our advisory-led approach ensures payroll accuracy, compliance alignment, and streamlined HR administration, allowing businesses to focus on growth while maintaining confidence in their workforce operations.

With extensive experience in hr payroll services, we help organizations optimize payroll processes, improve data integrity, and establish scalable HR systems. Our structured methodology ensures that payroll operations are compliant, confidential, and positioned to support business expansion.

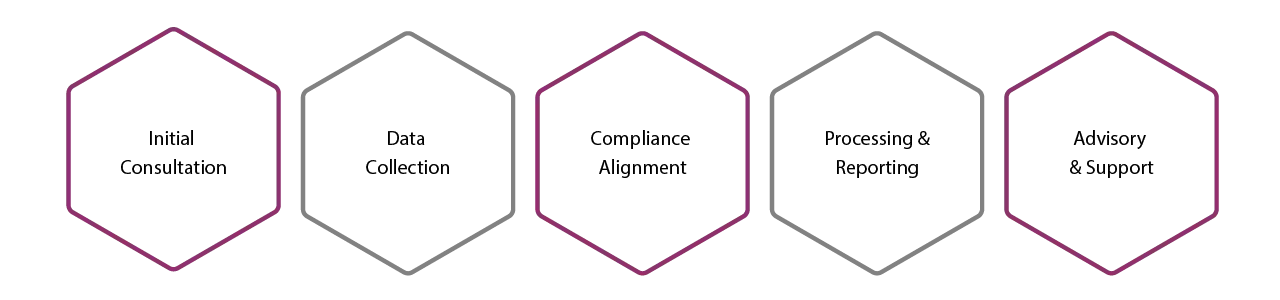

With deep expertise in hr payroll operations and regulatory compliance, Al Mawaleh delivers end-to-end HR and payroll support, from initial setup to ongoing monthly processing and advisory. Our team combines technical payroll expertise with practical HR governance, ensuring every engagement is built on accuracy, transparency, and compliance.

Key Differentiators Include:

Unlike conventional hr payroll outsourcing companies, our services extend beyond processing to include advisory, risk management, and continuous improvement.

Professional HR & Payroll Services are critical for businesses seeking operational efficiency and regulatory confidence. Accurate payroll processing ensures timely salary payments, which directly impacts employee morale and retention. Compliance with labour laws, social insurance, and statutory deductions protects organizations from penalties and legal disputes.

Additionally, structured hr payroll services support workforce planning, cost control, and governance functions that are often underestimated but vital to sustainable growth.

SMEs gain significant advantages from outsourcing payroll and hr services for small businesses:

Outsourcing human resources and payroll is not merely a cost-saving measure; it is a strategic approach to managing operational complexity and compliance effectively.

Outsourcing hr payroll outsourcing companies provides organizations with specialized expertise while eliminating the risks associated with in-house errors. It ensures continuous compliance with regulatory updates, enhances confidentiality, and delivers predictable operational costs.

This model allows businesses to benefit from professional payroll and hr services without investing in complex systems or internal resources.

Organizations often encounter challenges such as:

Without professional hr consulting, these challenges can quickly escalate into regulatory breaches and employee dissatisfaction.

To ensure accurate hr and payroll management, it is essential to provide complete and up-to-date documentation. These documents support compliant payroll processing, accurate salary calculations, and effective workforce administration.

Key Documents Needed:

Complete and accurate documentation is essential for reliable payroll execution, regulatory compliance, and audit readiness.

This structured approach ensures dependable HR & Payroll Services delivery.

| Project Stage | Estimated Timeline | Estimated Cost (OMR) | Notes |

|---|---|---|---|

| Initial HR & Payroll Setup | 5–10 working days | 500 – 1,200 | Depends on workforce size, data readiness, and system setup |

| Monthly Payroll Processing | Ongoing (monthly cycle) | 30 – 70 per employee/month | Includes salary processing, reporting, and compliance checks |

| HR Advisory & Support | As required | 50 – 80 per hour | Scope-based engagement depending on HR complexity |

Disclaimer: Timelines and costs are indicative and may vary based on workforce size, system complexity, level of customization, and data availability. Final pricing is confirmed after an initial assessment and scope definition.

AI strengthens HR & Payroll Services by improving accuracy, automation, and insight across payroll processes. Automated payroll calculations and validation checks reduce manual errors, while AI-driven anomaly detection identifies inconsistencies before they impact compliance or salary payments.

Predictive workforce cost analysis supports better budgeting and planning, and intelligent dashboards provide real-time visibility into payroll and compliance. Professional oversight ensures AI-driven outputs remain accurate, compliant, and reliable.

Our hr payroll services support a wide range of industries in Oman, providing customized solutions that align with each sector’s regulatory and operational requirements.

Industries That Benefit from Our Services:

Each industry receives customized payroll and hr consulting to ensure accuracy, compliance, and operational efficiency.

Ready to take your finances to the next level? Book an appointment with Al Mawaleh today! Our professional team is here to provide personalized solutions that clarify finances and build trust. Let’s work together to ensure your business’s financial success.

Al Mawaleh is recognized for delivering reliable, compliant, and scalable human resources and payroll solutions. Our experienced advisors combine local regulatory expertise with advanced technology to ensure payroll accuracy, confidentiality, and efficiency.

By leveraging AI-enabled tools and structured advisory methodologies, we provide end-to-end hr payroll services that reduce risk and enhance workforce governance. Our solutions are designed not only to meet today’s requirements but also to support long-term business growth through disciplined HR and payroll management.

Our solutions are designed to meet current HR and payroll requirements while supporting long-term business growth through disciplined, scalable, and efficient workforce management. Businesses gain not only operational excellence but also strategic insight, enabling smarter decision-making and stronger employee satisfaction.

Al Mawaleh is a leading financial consultant company in Oman, delivering expert accounting services, professional auditors, and trusted financial solutions advisor support for businesses through top financial consulting firms expertise.