- Welcome to Al-Mawaleh

- Majan building , Opposite CSK cafe ,Ghala,Muscat Governorate,Sultanate of Oman

Turn your idea into reality: Start your company, stress-free.

Setting up a business in Oman is no longer just an opportunity — it’s a strategic move. With 100% foreign ownership now allowed in many sectors, zero personal income tax, and rapidly growing free zones, Oman is quickly becoming a hotspot for entrepreneurs, startups, and investors looking to expand into the GCC region. Whether you’re eyeing a limited company formation, a free zone setup, or a full-scale LLC company formation in Oman, understanding the latest laws, documentation, and procedures is essential. That’s where Al Mawaleh steps in — offering end-to-end company formation services in Oman backed by expertise, speed, and full compliance with local regulations.

Business formation demands a deep understanding of company formation law in Oman, market trends, and cost structures. That’s why many turn to business setup consultants and company formation agents like Al Mawaleh to streamline the process. From choosing the right company document format and drafting agreements to understanding the business setup cost in Oman, we ensure no detail is overlooked.

Before diving into paperwork, it’s crucial to understand why business formation in Oman is so appealing in 2025. Oman’s Vision 2040 has opened doors for foreign investment across key industries like logistics, tourism, mining, manufacturing, and IT. The government has streamlined company registration in Oman through the Ministry of Commerce, Industry and Investment Promotion (MOCIIP), allowing for faster approvals and reduced bureaucracy.

You’ll find both mainland and free zone company formation options in Oman, each with its own advantages. Free zones offer full repatriation of profits, customs exemptions, and simplified company registration in Oman, making them a top choice for export-oriented businesses. Meanwhile, mainland setups allow greater flexibility when dealing directly with the local market.

Oman’s foreign investment law allows up to 100% foreign ownership in many sectors without needing a local sponsor. However, certain regulated activities may still require a local partner or agent. Our legal specialists guide you in compliance and assist with drafting formal paperwork — whether it’s a formal company letter format, contracts, or a resignation letter format for company employees

Businesses must comply with:

Choosing the right legal structure is the first major decision when starting a business. Understanding the structure that best suits your goals is vital — whether you’re looking for ltd company formation, LLC company formation , or a low-commitment branch. In Oman, the most common types of companies include:

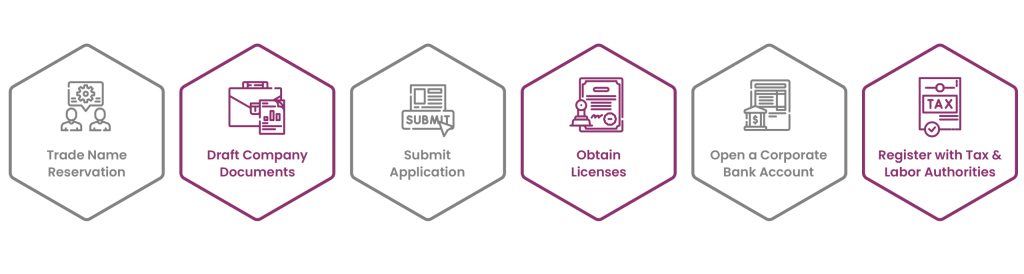

The process typically takes 7–14 working days with the support of experienced company formation agent.

Our team at Al Mawaleh assists in preparing all formats — from a clean company profile format to a valid agreement format between company and client — aligned with local authority expectations. To ensure smooth company registration in Oman, you will need to prepare the following:

For Individual Shareholders:

For Corporate Shareholders:

Other Documentation:

At Al Mawaleh, we also provide a detailed company quotation format upon request — itemized and fully transparent. Here’s a general estimate of the business setup cost in Oman:

Service | Cost (Approx.) |

Trade name registration | OMR 50 |

Commercial registration | OMR 100–300 |

License fees (activity-based) | OMR 150–1000 |

Legal documentation & translation | OMR 200–500 |

Office rent (Muscat, small office) | OMR 200+/month |

Visa & labor card per person | OMR 300–500 |

Note: Costs vary based on sector, location, and activity.

When it comes to company formation services, experience matters. At Al Mawaleh, we combine legal precision, market insight, and personalized consulting to simplify every stage of your journey — from planning to launch.

We handle everything:

If you’re looking for the best company formation agent in Oman who delivers speed, transparency, and deep knowledge of companies formation law in Oman, you’re in the right place.

Ready to take your finances to the next level? Book an appointment with Al Mawaleh today! Our professional team is here to provide personalized solutions that clarify finances and build trust. Let’s work together to ensure your business’s financial success.

100% foreign ownership no income tax and location via Oman company formation.

Choose your business activity and structure, reserve a trade name, prepare legal documents, and register with MOCIIP with support from a trusted company formation agent like Al Mawaleh.

We guide you to register a ltd company as your best company formation agent.

Yes. In most sectors, 100% foreign ownership is now allowed without a local sponsor.

Tax exemptions, full profit repatriation, and no import/export duties.

Al Mawaleh is a leading financial consultant company in Oman, delivering expert accounting services, professional auditors, and trusted financial solutions advisor support for businesses through top financial consulting firms expertise.