- Welcome to Al-Mawaleh

- Majan building , Opposite CSK cafe ,Ghala,Muscat Governorate,Sultanate of Oman

Stay UBO-compliant, stress-free.

The Ultimate Beneficial Owner (UBO) declaration is a critical regulatory requirement for businesses in Oman. It identifies the individuals who ultimately own or control a company, promoting transparency and compliance in the fight against money laundering and financial crime. The UBO framework aligns with global standards, including recommendations by the Financial Action Task Force (FATF), and reinforces the country’s commitment to Anti-Money Laundering (AML) efforts.

In Oman, UBO requirements are enforced by the Ministry of Commerce, Industry & Investment Promotion (MoCIIP). Whether for initial filings or annual renewals, businesses must ensure their submissions are timely, accurate, and compliant to avoid penalties. At Al Mawaleh, we simplify the entire process of UBO filing in Oman, offering customized solutions to manage documentation, renewals, and updates. Our expert team ensures that your business remains compliant while you focus on growth and operations.

Initial UBO Submission

Annual UBO Renewal

Updates Required in Case of Ownership Changes Any transfer of shares, changes in shareholders, or shifts in control must be promptly reported to the authorities.

To ensure a smooth UBO submission process, the following documents are typically required:

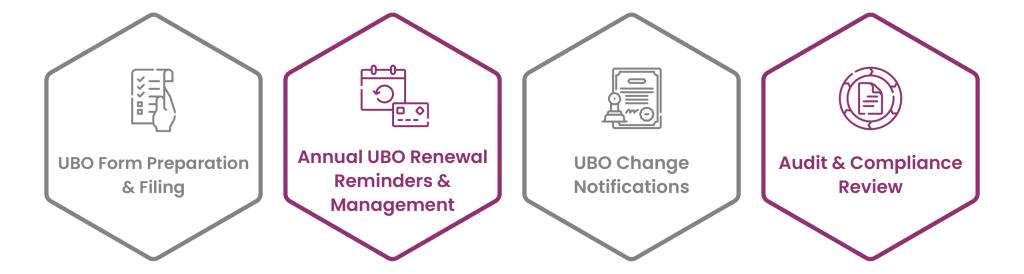

UBO Form Preparation & Filing

Annual UBO Renewal Reminders & Management

UBO Change Notifications

Audit & Compliance Review

Deep Knowledge of MoCIIP Requirements: Our experts stay informed on the latest regulations and procedural updates from Oman’s Ministry of Commerce, Industry & Investment Promotion.

Full Confidentiality & Accuracy: We handle all sensitive ownership information with the utmost security and precision.

End-to-End Compliance Support: From initial UBO registration to annual renewals and ownership updates, we provide comprehensive support to ensure peace of mind.

Ready to take your finances to the next level? Book an appointment with Al Mawaleh today! Our professional team is here to provide personalized solutions that clarify finances and build trust. Let’s work together to ensure your business’s financial success.

Late or non-compliance with UBO submission requirements can result in financial penalties and legal consequences for companies.

No, a nominee shareholder does not qualify as a UBO. The UBO must be a natural person with significant control or ownership.

Yes, UBO submission is mandatory for all legal entities operating in Oman as part of regulatory compliance.

Changes in shareholder structures, transfer of shares, or alterations in control or influence over the company necessitate an updated UBO filing.

Al Mawaleh is a leading financial consultant company in Oman, delivering expert accounting services, professional auditors, and trusted financial solutions advisor support for businesses through top financial consulting firms expertise.